Navigating the 2023 R&D Tax Relief Changes: A Comprehensive Guide

Unpacking the 2023 R&D Tax Relief Reforms: Secure Your Business's Future

As the landscape of R&D Tax Relief transforms this year, it's essential for your business to stay updated on the new rules. These significant shifts will affect your relief entitlements, eligible expenses, and filing procedures with HMRC. Deviation from the new guidelines could spark a lengthy inquiry, hindering your relief and damaging your HMRC rapport. Let's walk you through these alterations and how they should influence your future R&D Tax Relief submissions.

R&D Tax Relief Rates: What’s Changed?

The year 2023 has ushered in significant changes to the R&D Tax Relief rates, reshaping the SME R&D Tax Relief scheme and the Research and Development Expenditure Credit (RDEC).

The SME R&D Tax Relief scheme is now less bountiful, with the enhancement rate plummeting from 130% to 86%. However, there's a silver lining for profitable companies as the corporation tax hike could offset the sting of the reduced enhancement rate.

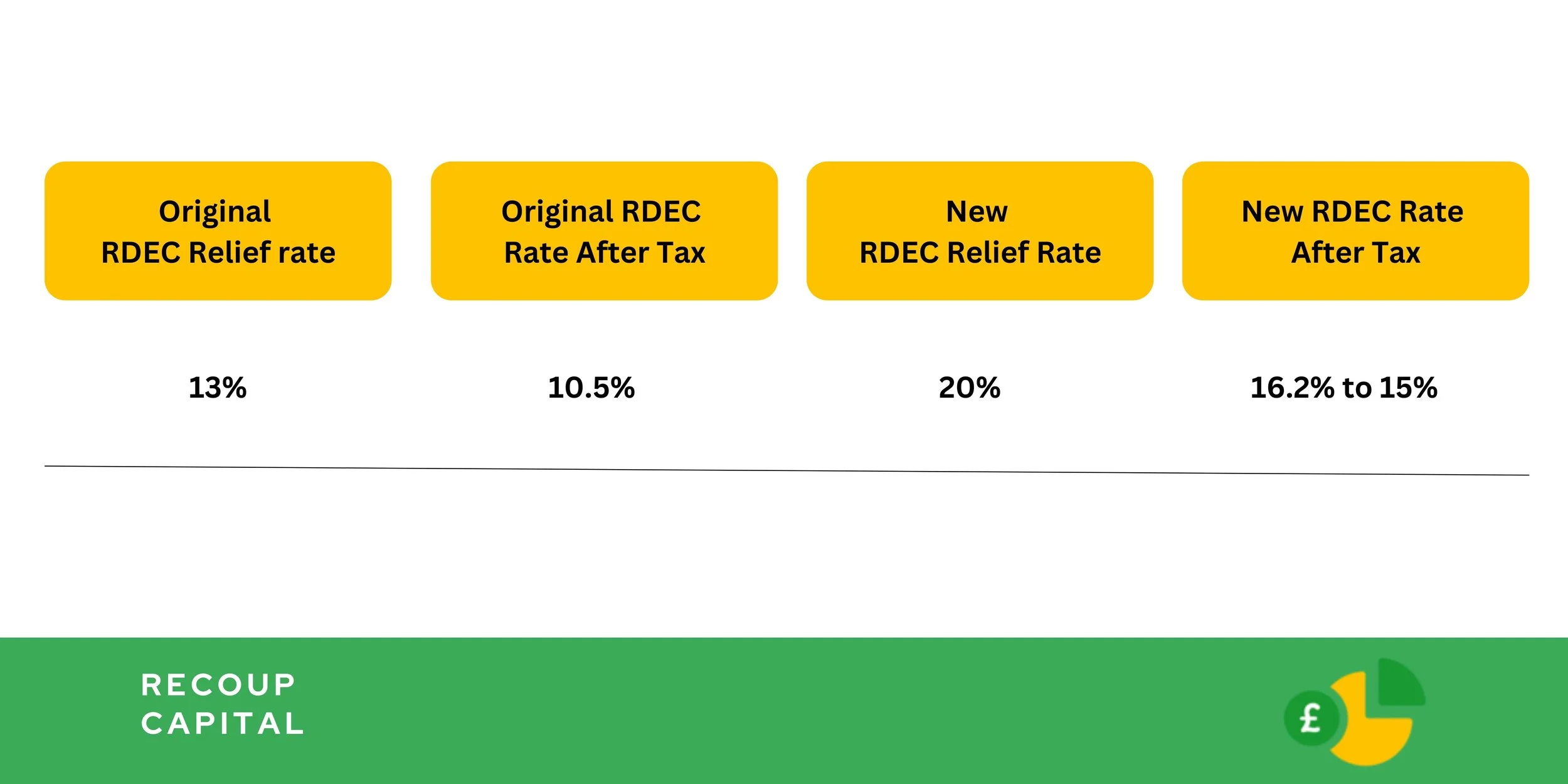

Conversely, the RDEC scheme has become more rewarding, with a leap in its rate from 13% to 20%. This surge means your company can enjoy between 42% and 54% more tax relief, depending on its profitability.

More Eligible Costs & New Filing Requirements: What Do They Mean for You?

A broader range of costs, including some cloud computing and data licensing costs, now qualify for relief, making your R&D efforts more beneficial. The revised guidelines also recognise pure mathematics activities as qualifying work, expanding the scope of your eligible expenses.

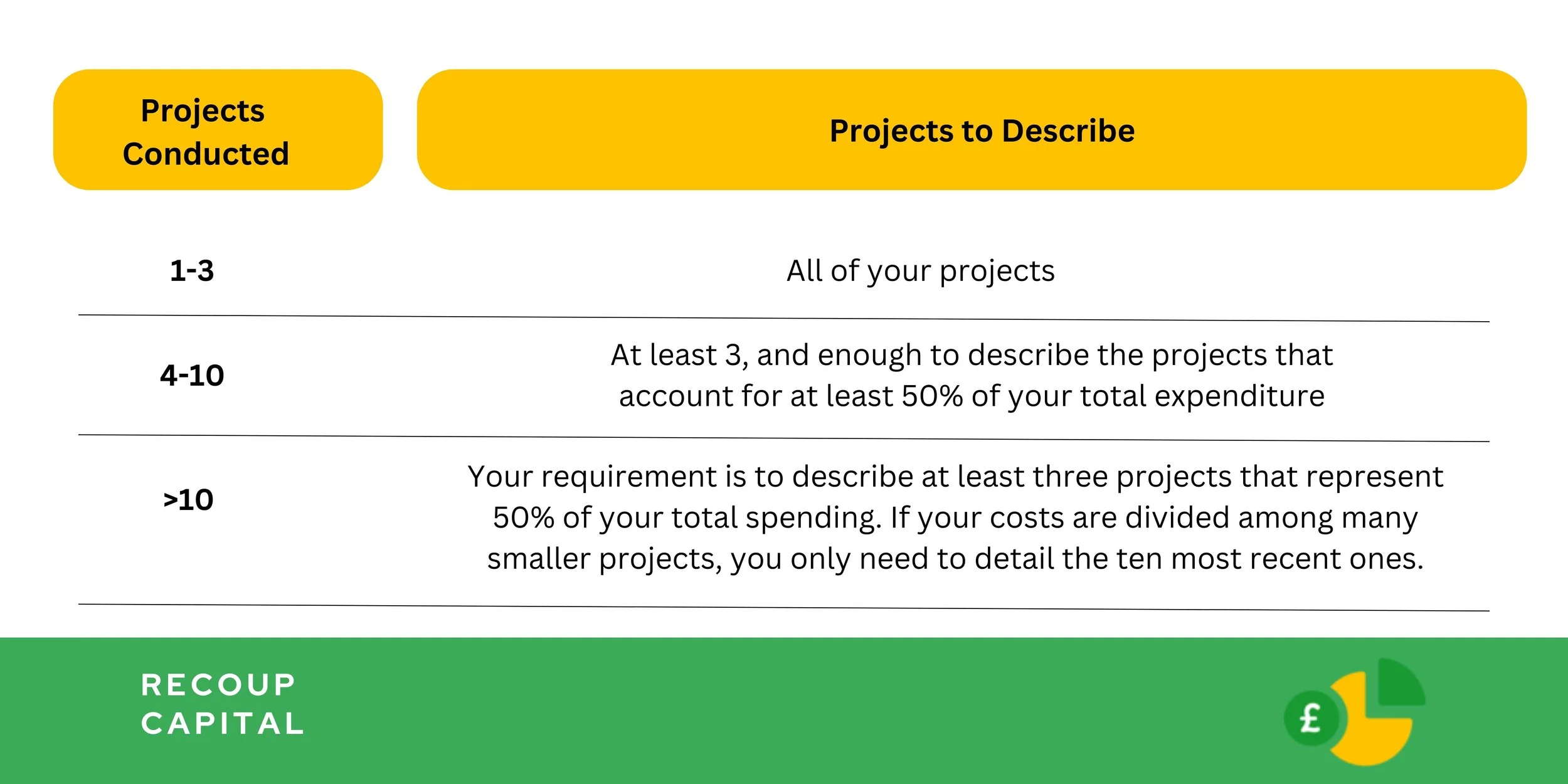

From 8 August 2023, HMRC will require an exhaustive report of your research and development work via the new ‘additional information form’. Neglecting this could lead to automatic claim rejection. This form will demand intricate details about your projects, your qualifying expenditure, qualifying indirect activities, and specific company information.

Stay Ahead with Expert Support

The tides are changing, and adapting to the R&D Tax Relief changes is a necessity. The professionals at Recoup Capital are prepared to guide you through these reforms, helping you understand their implications and how to tailor your upcoming R&D Tax Relief submissions.

Don't let these changes disrupt your business operations. Reach out to us today, and let our specialists assist you in making the most of your R&D Tax Relief claims.

Book a free consultation here